Here are some steps you can take to get started with the estate planning process, even before you meet with an attorney to work on any legal documents.

The Coming Collapse of Long-Term Care Health Insurance

Routine estimates predict that about 50 percent of older adults will require long-term care at some stage of their lives. If you are an adult 65 or more, the percentage moves up to 70 percent. However, the demand for long-term care far outnumbers an affordable or even existing supply. For years the private sector long-term care insurers have been fleeing the marketplace. Americans who currently carry long-term care insurance are a small fraction, about 7 percent, adults over 50 years of age. There is a private sector inability to meet Americans’ overwhelming long-term care needs at an affordable price. The US healthcare system’s long-term care options are rapidly faltering as it is impossibly expensive, inefficient, and a poor performer for both seniors and industry.

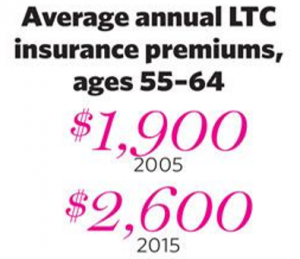

Long-term care provides a broad array of supports and services to elderly patients and the disabled in daily life activities. These activities include bathing, toileting, dressing, transferring, and eating. Long-term care is also support for patients who have Alzheimer’s, dementia, diabetes, and other chronic conditions. Providers of long-term care operate in nursing homes, assisted living facilities, and private homes. Fewer than one in thirty Americans own a long-term care (LTC) insurance policy, and only about seven percent are adults are over the age of 50. Despite the aging US population, the raw figure of 7.5 million LTC insured has barely moved since 2008. According to prospect.org, these statistics come as no surprise as LTC insurance premiums keep increasing while average policy benefits decrease, as shown below.

When long-term care became part of the health care insurance industry in the 1970s, there was a wild mispricing error due to poor actuaries, which severely underestimated the cost of such plans. Subsequently, some insurers have abandoned the market altogether. In the year 2000, there were 100 policy providers; there are fewer than a dozen today, and it is harder than ever to become qualified. Insurers strain to deny policy applications to as many people as possible.

The American Association for Long-Term Care Insurance (AALTCI) finds that between 44 to 51.5 percent of applicants aged 70 or more are declined coverage. Nearly one-third of adults between 60 and 65 are refused. Even those in their 50s experience a 21 percent rate of application refusal. Rejection is prevalent because any combination of two or more chronic conditions is a basis for near-automatic disqualification. Certain diseases are also grounds for denial, such as AIDS, diabetes requiring insulin shots, stroke history, and multiple sclerosis, to name a few.

Despite large premium increases and increasingly difficult qualifications, long-term care claim losses sill exceed expectations and have since 2008. Under current market conditions, insurers find it impossible to structure a profitable long-term care program. Moreover, many insurance coverages for the senior living industry are experiencing increases in their rates and premiums. Some insurance brokers report that even accounts with a clean loss history are experiencing premium increases at a minimum of 12 to 15 percent. Additionally, in the next year to two years, assisted facilities’ insurance costs could double or triple. Average policy benefit payouts will find it difficult to address the future long-term care needs. Carriers are consolidating to remain profitable, but this is shrinking senior living market coverage. Facilities have fewer options, and remaining insurance carriers increase premiums as they continue to restrict coverages and limits. The situation is bad news for seniors and near seniors, as rising business costs are generally passed on to the consumer.

Elements of sticker shock, denial of need, and wishful thinking keep most Americans from purchasing a long-term care plan even though they will most likely need one in their later years. Meanwhile, private long-term care insurance is in jeopardy as a result of industry non-profitability. Even with critical need, without government intervention, there is a looming collapse of the long-term care insurance market.

If you are concerned about how you or a loved one will pay for long-term care, we can help. Contact us to set up a time to discuss planning opportunities that may be available to help lessen the financial burden of long-term care. Please Contact our New York office or call 914-498-8709.